Secret Has actually and Pros the fresh DHFL Financial Home loan EMI Calculator

DHFL financial calculator can help you assess their monthly payments with ease. From the entering the loan number, period, and rate of interest, new DHFL home loan EMI calculator provides a precise guess, making sure greatest financial planning your residence loan.

It takes lots of union and you will lookup order your fantasy family. Its an emotional task that really needs mindful considered and you can performance. Surviving in a secure environment sufficient reason for a powerful structure are only a couple of aspects of they. Before applying having a mortgage, you must make sure that your earnings and you may mental well-becoming come in acquisition.

Before you apply getting a home loan, you could potentially influence their month-to-month instalments using the DHFL financial EMI calculator. Planning your costs is very important to steer clear of any possible financial hardships. They helps with choice-and work out and you will has actually you organised about techniques.

Before applying getting a home mortgage, be certain that you’re aware of what you there is to know concerning on the internet EMI calculator.

Should you decide purchasing yet another house or apartment with a good DHFL financial, it’s important to package your own expenditures to prevent any trouble later toward. With this thought, utilizing the DHFL financial financial EMI calculator can be quite of good use. Before you apply, here are numerous justifications for making use of the new DHFL lender mortgage EMI calculator.

- You could potentially determine regardless if you are deciding on the top option for your finances from the contrasting the EMI cost with other rates of interest available with almost every other legitimate Indian finance companies.

- Additional loan quantity, interest rates, and you will tenures are typical possibilities that you will be able to look for. With the help of this mode, you can easily decide which bundle is the best for you out of all of the available options.

- You are able to the brand new calculator to assess the remainder mortgage years inside the period, that’ll make clear the installment techniques for you.

- They spends the home loan EMI algorithm: p*r*(1+r)n/([1+r)n]-1 to make sure you have the appropriate matter youre needed to shell out. You can rely on new EMI calculator from DHFL mortgage brokers partially since the conclusions is perfect.

- Before making a decision, fool around with solution on line EMI hand calculators out of various banking institutions if you feel brand new numbers shown do not satisfy your budget.

- Despite you have accepted the loan, you can nonetheless visit the certified webpage and you will apply the net EMI calculator to verify your own status to discover just how much is nonetheless due for the rest of the brand new loan’s name.

Secrets which affect Home loan EMI

- Recognized loan amount: Before you take aside a loan, the total loan amount will have big region during the determining just how much your own EMI could well be. In the event the amount borrowed is more as well as the home loan period was less, your payment per month matter increases automatically. Interest rates while doing so go up in the event that amount borrowed is on the large front.

- Interest rates: Among the secret determinants off EMI pricing ‘s the notice price. This new EMI immediately increases after the title when rates are still highest. DHFL handled their interest rate from the 8.75% for everyone of their website subscribers. Evaluate their preparations before applying to own a property loan to see which one is best for your.

- Tenure: Our home financing period years you select prior to taking aside a good financial greatly influences the amount you’ll have to pay down fundamentally. The new payment develops for the duration of the book. You will need to shell out lower month-to-month figures once the title lengthens. However, extent payable as well as goes up after you favor a longer period out-of 20 so you can three decades. For additional info on online personal loans NV casing financing principal cost, see this site.

Note: To make certain you are by using the right amount that suits your affordability, you could swap away these philosophy whenever calculating your EMI using the house financing EMI calculator India DHFL.

Exactly how a keen EMI Amortisation schedule aids in EMI fees?

A keen amortisation schedule is actually a dining table that showcases brand new bifurcation away from the EMI commission in two pieces dominating amount and you can attract count. New amortisation agenda can certainly help your for the understanding how much commission of every EMI percentage is just about to the principal number.

Utilizing the amortisation agenda calculator, you can keep track of your repayments and you will people a fantastic attention. Additionally, it may will let you replace your meant financing installment bundle. With an enthusiastic amortised financing, you can repay the borrowed funds quicker because of the increasing the amount because of the lender per commission. You could more and more enhance your collateral if you are paying the brand new loan’s principal and you will notice additionally that with an EMI amortised schedule to own mortgage loans.

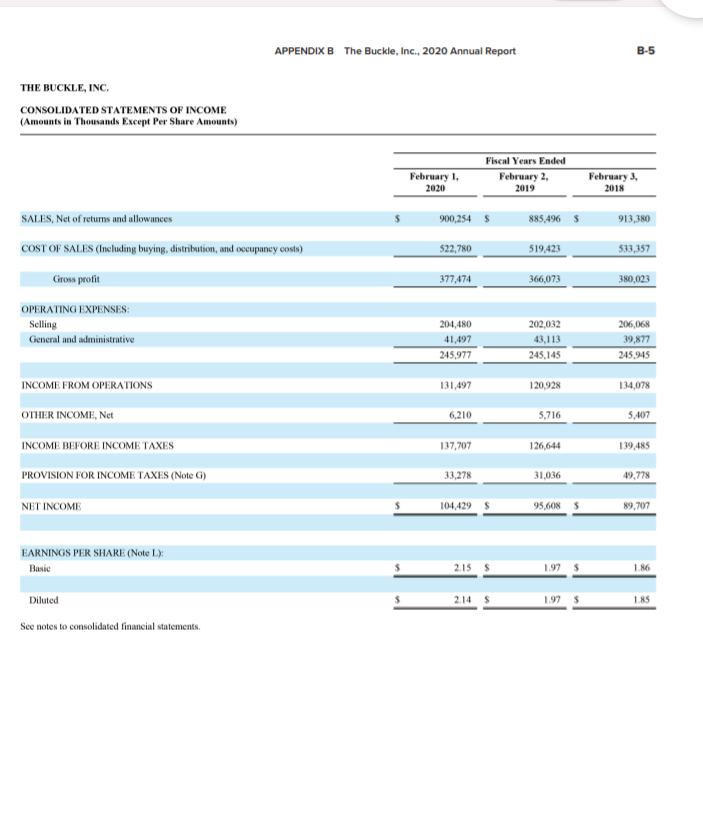

Investigations Of Home loan Cost of SBI, HDFC, ICICI, Kotak Mahindra & most other Banks

DHFL already also provides their website subscribers lenders that have rates doing in the 8.75%. Less than is the mortgage emi evaluation of different financial institutions:

DHFL Financial Property Loan EMI Calculator for several Number

Notice : If you want to understand what is the algorithm so you’re able to determine emi to possess mortgage, then right here its: [P x R x (1+R)^N]/[(1+R)^N-1].

How do NoBroker Aid in choosing Home loan?

NoBroker are a real house program which provides thorough financial research and you may services. Due to their member-amicable construction and easy units, you can also quickly and easily calculate your home financing EMI. You can aquire an exact estimate of the month-to-month repayments from the going into the platform’s loan amount, rate of interest, and you will period.

In addition, NoBroker will help you for the contrasting several mortgage also provides regarding individuals loan providers so that you can build the best choice. You can be sure you get the very best rate towards your property financing along with their qualified advice and help. At the same time, NoBroker can save you effort of the helping which have the borrowed funds app process. Into the 100 % free DHFL home loan EMI calculator, you could start on the road to reaching your aim away from owning a home.